Department of Selective Charts: Social Security Tax Cap Division | American Enterprise Institute - AEI

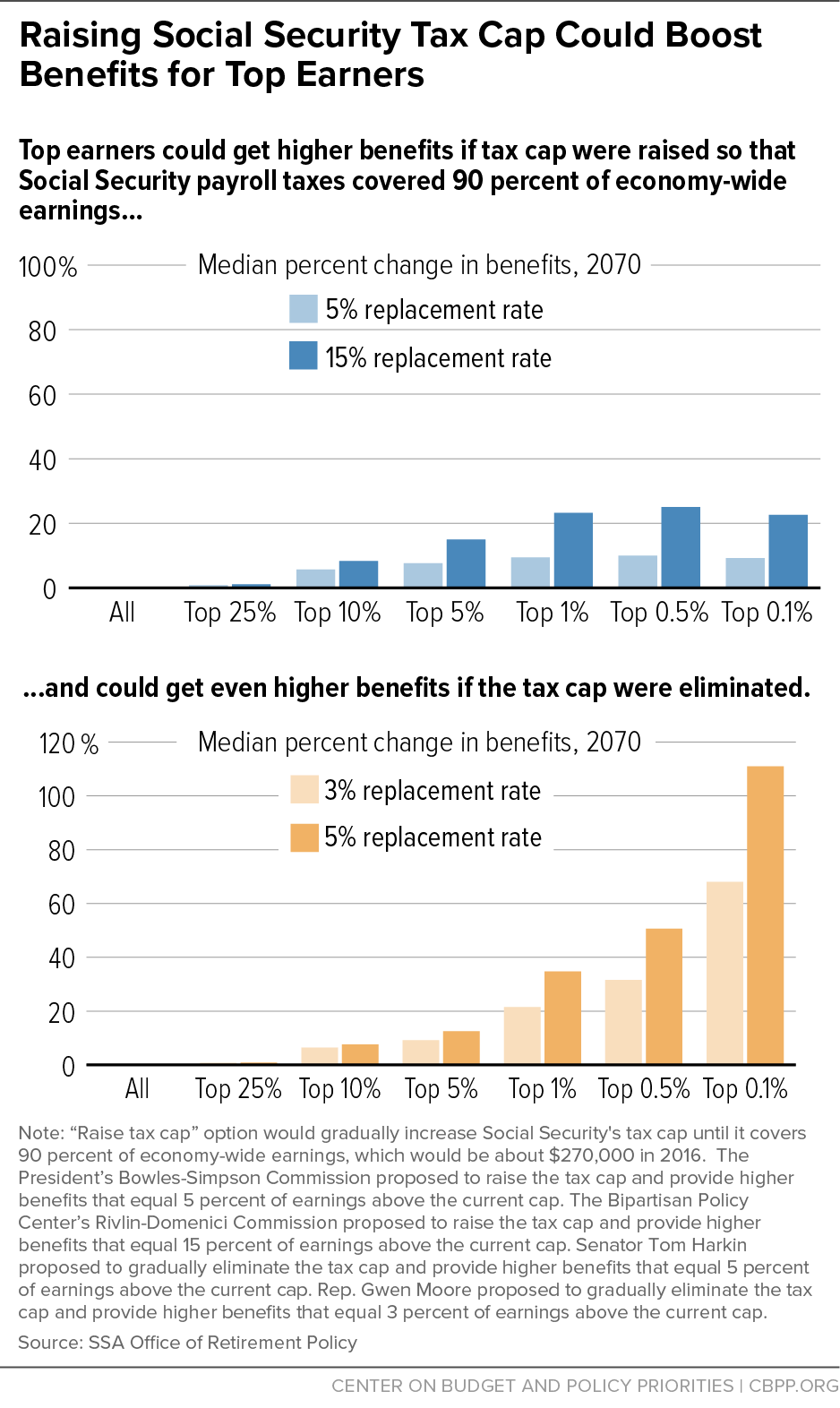

Richard Angwin on X: "The social security earnings cap is a subsidy for the wealthy. Ending it would close the funding gap and make social security permanently solvent. #EndTheCap https://t.co/UhINVK7yPH" / X

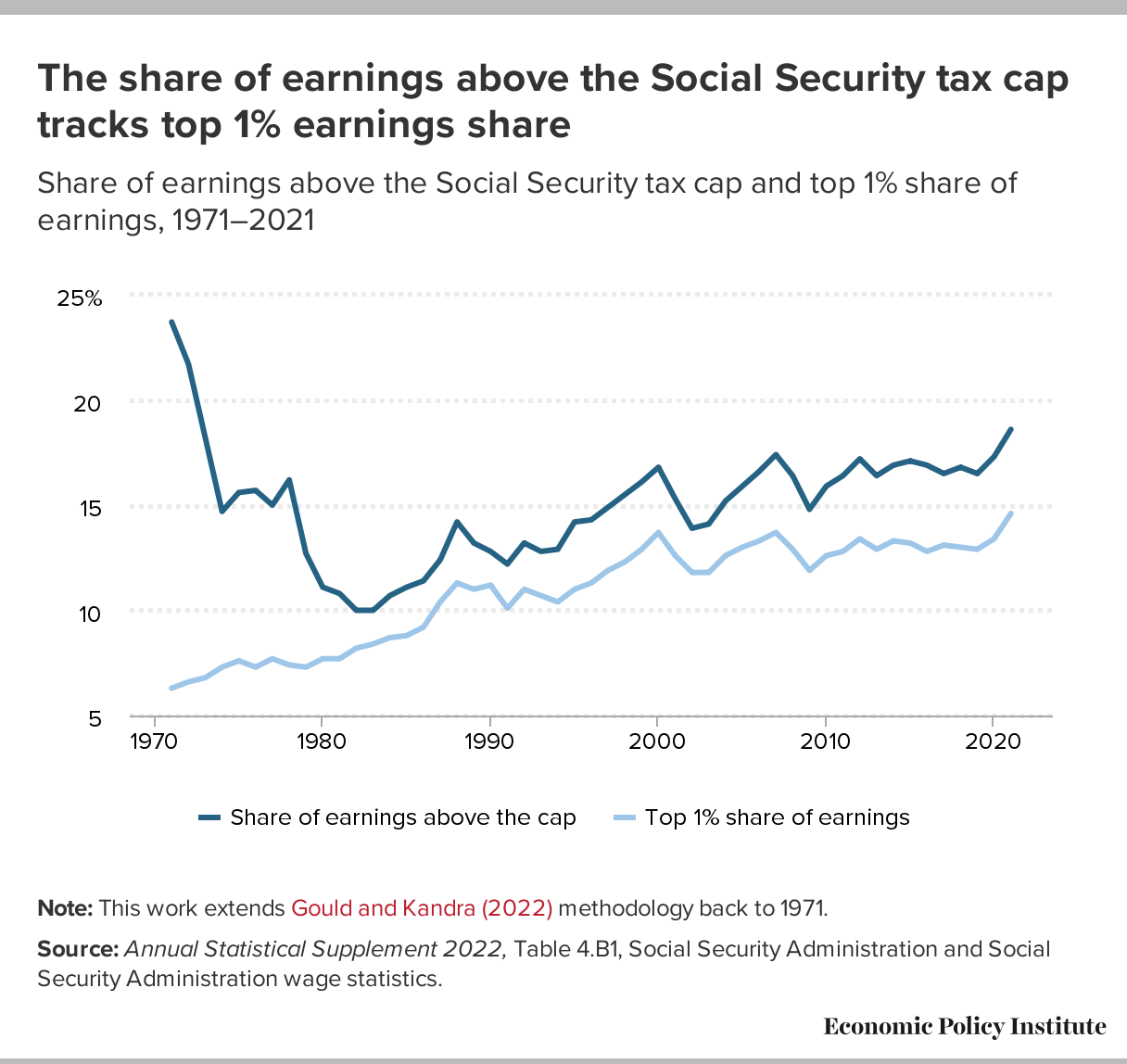

Removing the Social Security earnings cap virtually eliminates funding gap | Economic Policy Institute

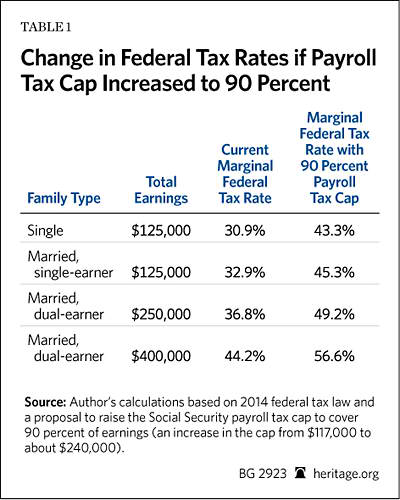

Raising the Social Security Payroll Tax Cap: Solving Nothing, Harming Much | The Heritage Foundation

![Social Security Earnings Limit [UPDATED] - YouTube Social Security Earnings Limit [UPDATED] - YouTube](https://i.ytimg.com/vi/tX8mJUnJUkA/sddefault.jpg)

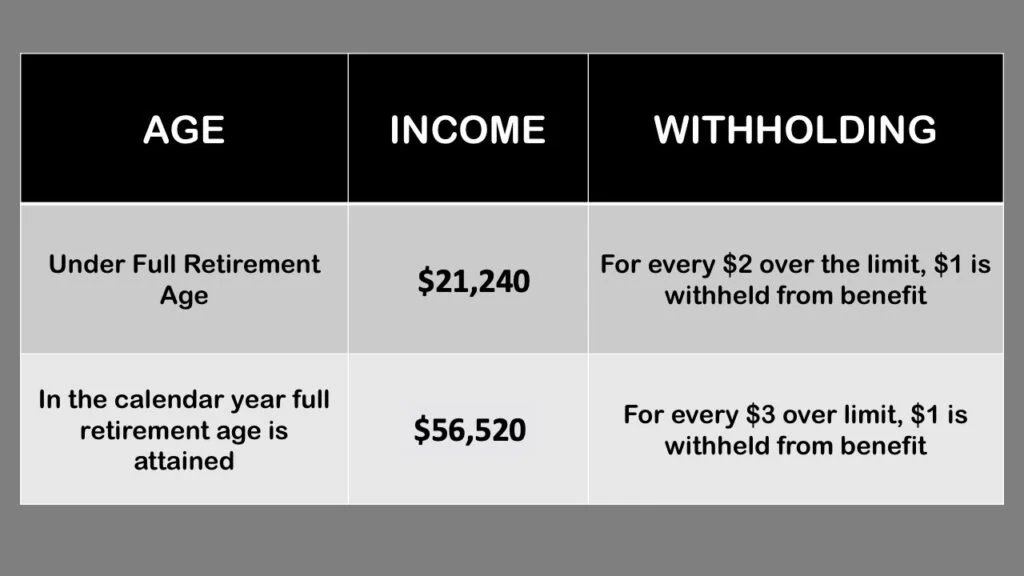

:max_bytes(150000):strip_icc()/how-does-the-social-security-earnings-limit-work-2388828-67b02d88fe9d4a5ba61fd301136a7424.png)

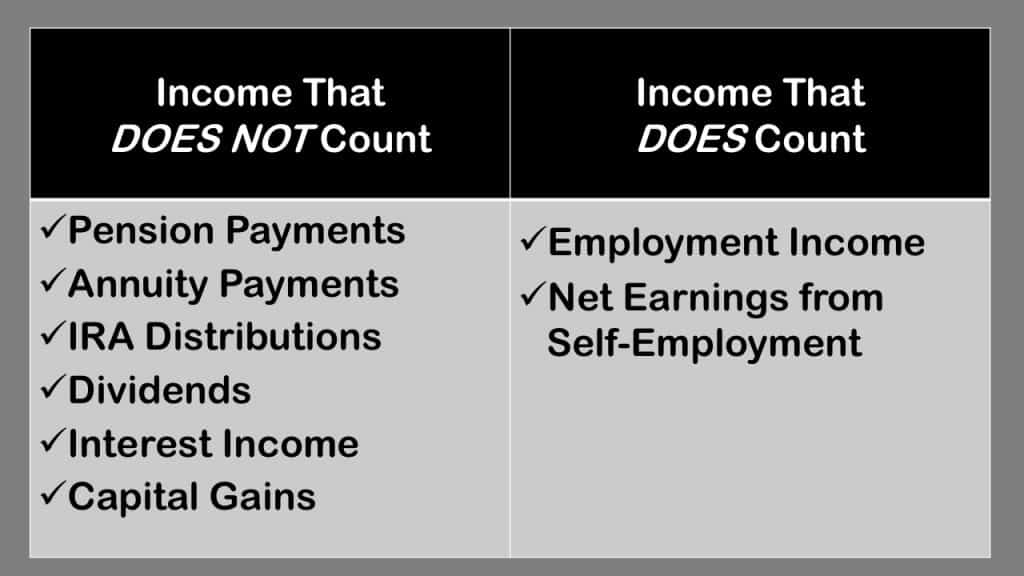

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)